In the past, people used a ledger to keep details about sales and compare them with the tax regulations. The system was sluggish, and many mistakes would happen for a little miscalculation.

But those days are long gone. People now use modern and advanced ways to calculate the GST with the helping hand of Microsoft Excel.

In this article, I’ll provide multiple efficient methods to create and do GST reconciliation without errors using Excel.

So, let’s begin.

What is GST Reconciliation in Excel?

GST Reconciliation in Excel is a process of comparing and matching the sales and purchase data recorded in the company’s accounting system with the corresponding data reported in the GST portal. It’s a must to align information and submit it to the tax authorities.

GST, or Goods and Service Tax, is applied to every product and service you use daily. The amount is added to the original cost of the product/services you get from a shop, company, or business.

Comparing and matching thousands of data from multiple sources is difficult for anyone. The Excel GST Reconciliation makes the job easy and allows you to complete it using various suitable methods.

In Microsoft Excel, you can create a reconciliation worksheet and include the transactions, sales, and purchases to compare them with equivalent entries in GST returns.

GST reconciliation is important to make sure tax filing accuracy, identifying errors, complying with laws, minimizing tax penalties, and efficiently handling all the massive data.

A well-organized and accurate GST reconciliation in Excel can help you ensure compliance with tax regulations and maintain the integrity of your financial data.

How to Create GST Reconciliation in Microsoft Excel

To create a GST Reconciliation Format in Excel, you can use the VLOOKUP function and find the differences between the two workbooks. In addition, you can combine the two sheets and apply the SUM function or use the Pivot Table method to reconcile GST.

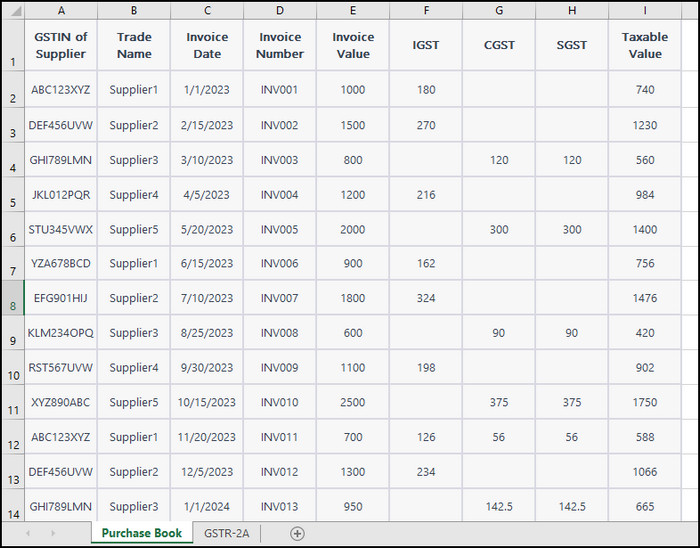

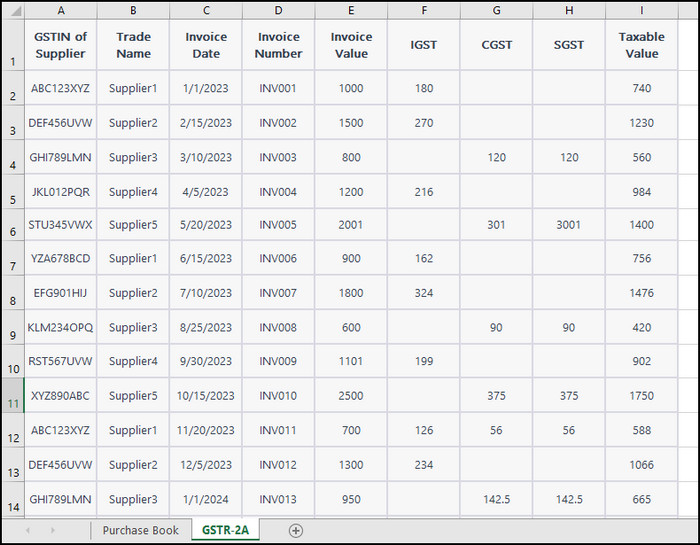

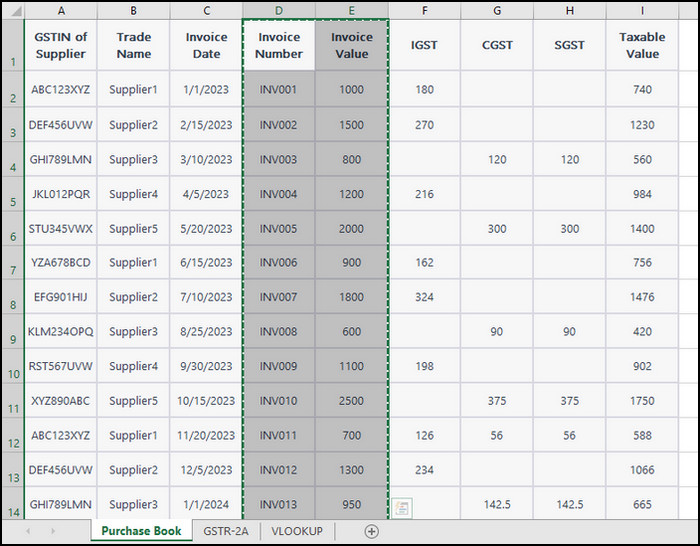

We will use two data sets, Purchase Book and GSTR-2A, for calculating the GST Reconciliation.

Data Sheet 1:

Data Sheet 2:

Both worksheets contain information about the GSTIN, Invoice Date, Invoice Number, Invoice Value, IGST, CGST, SGST, and Taxable Value.

Let’s check out the process of creating GST reconciliation using different methods in Microsoft Excel.

Here are the ways to do GST reconciliation in Excel:

1. Use VLOOKUP

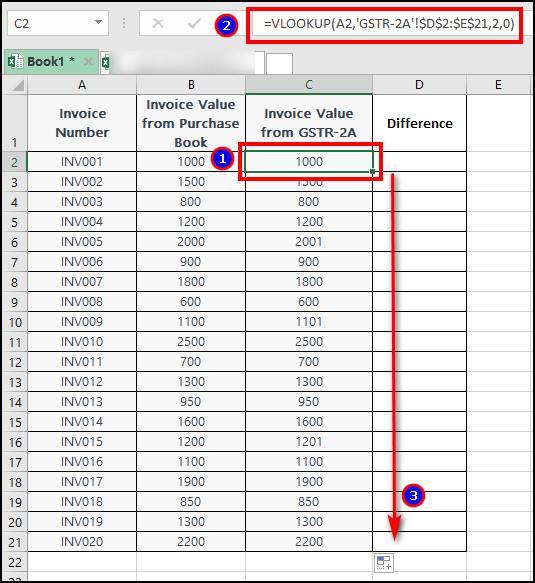

With the VLOOKUP function, we will match the Invoice Number and take the Invoice Value from the Purchase Book and GSTR-2A.

Follow the steps below to calculate GST reconciliation using the VLOOKUP function:

- Create a VLOOKUP worksheet in Excel.

- Copy the Invoice Number and Invoice Value from the Purchase Book and paste them into the VLOOKUP sheet.

- Create a new column named Invoice Value from GSTR-2A in the VLOOKUP sheet.

- Apply the VLOOKUP function in the C2 cell.

- Drag to autofill the following cells.

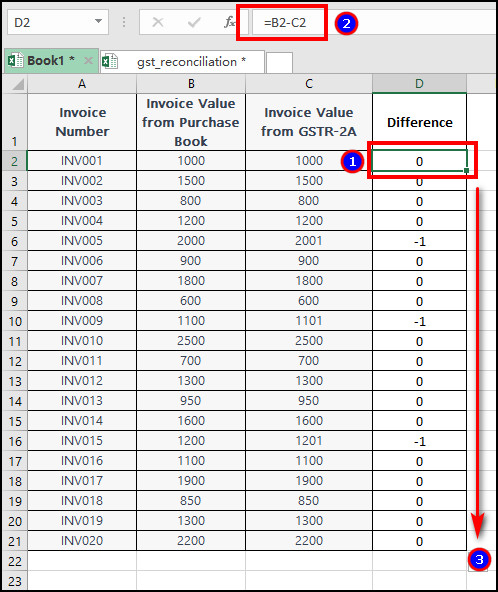

- Create a Difference column and subtract C2 from B2.

The reconciliation is complete if you find zero in the difference. But, if there are other values, you can find and correct them.

We’ve used the sheet as a reference in the Excel cell to get the value from another place.

Similarly, you can use INDEX and MATCH functions in place of VLOOKUP to find the same result.

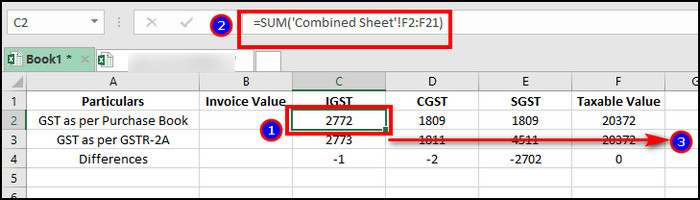

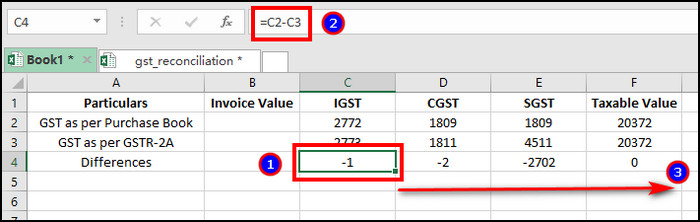

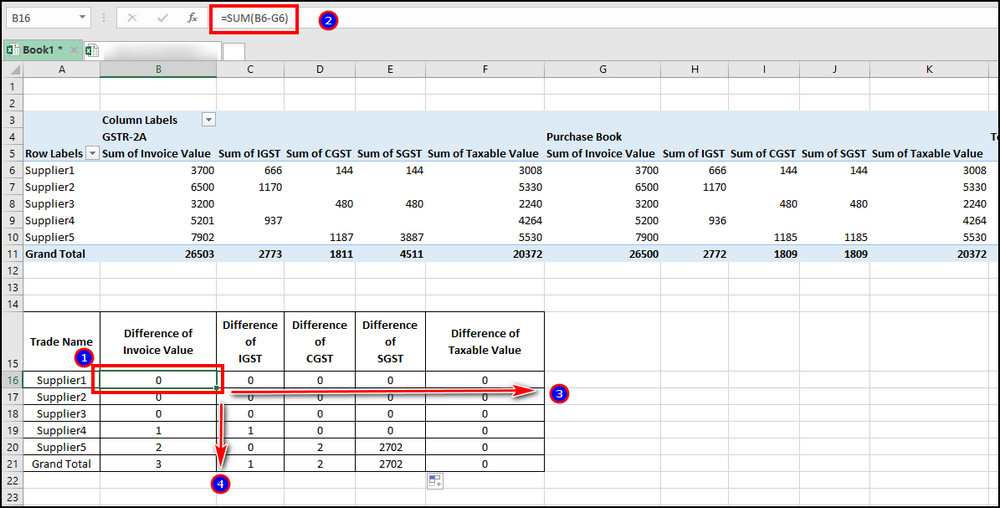

2. Use SUM Function

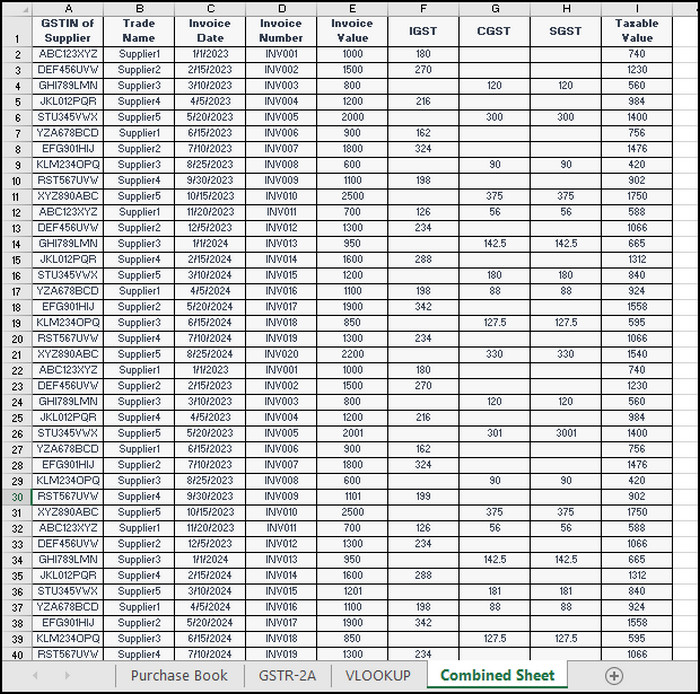

You can also combine the Purchase Book and GSTR-2A sheet and find the differences for each category using the SUM function.

Here is the procedure to find GST reconciliation in Excel using the SUM function:

- Copy and combine the Purchase Book and GSTR-2A reconciliation into the Combined Sheet.

- Apply the SUM function in C2 to find the IGST for Purchase Book.

- Drag to autofill CGST, SGST, and Taxable Value.

- Use the same method to find IGST, CGST, SGST, and Taxable Value for GSTR-2A.

- Find differences between C2 and C3.

- Drag the cell to calculate the difference between CGST, SGST, and Taxable Value.

The zero shows no error in that reconciliation, and the other value suggests correcting the error in your worksheet.

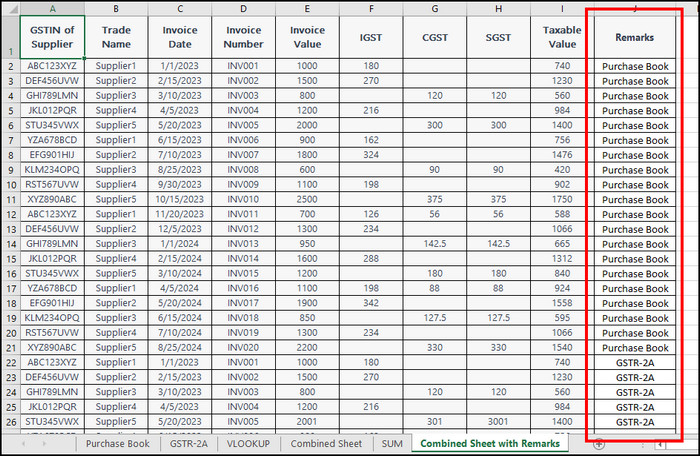

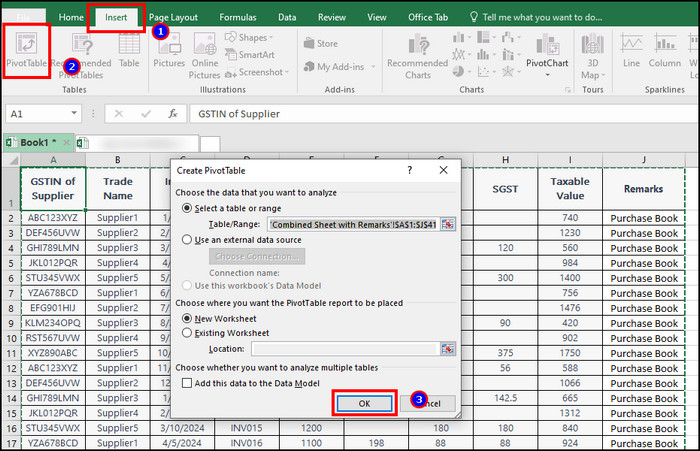

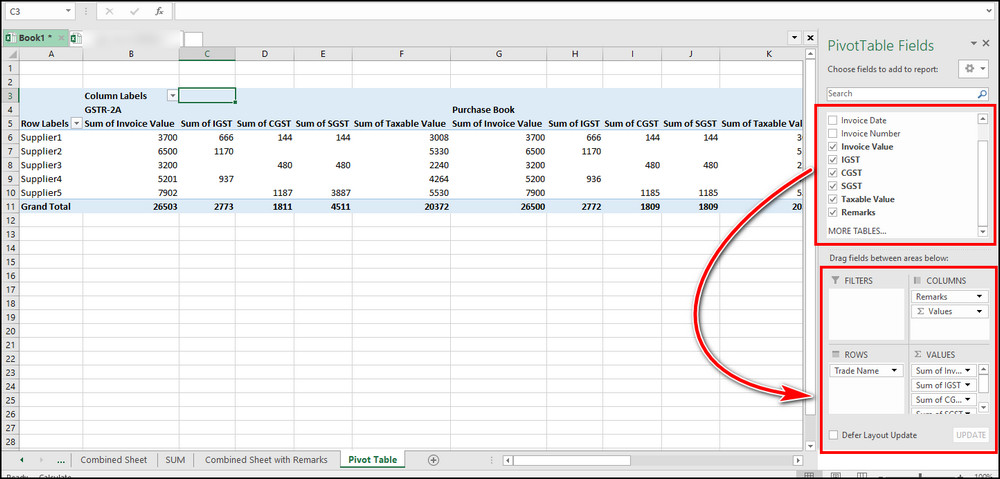

3. Use Pivot Table

A pivot table is another way to do GST reconciliation. It’s applied to find errors in large amounts of data quickly.

Here are the steps to find GST reconciliation using Pivot Table:

- Copy the Combined Sheet and create a new sheet with the Remarks column.

- Go to Insert and click on Pivot Table.

- Press on OK to create a new sheet.

- Drag the Pivot Table elements to different areas.

- Find the differences in Invoice Value, IGST, CGST, SGST, and Taxable Value between Purchase Book and GSTR-2A.

Now, check the values other than zero and correct the reconciliation in GST.

Download Free GST Reconciliation Worksheet

I’ve provided all the formulas and methods in the Excel GST reconciliation practice worksheet below. You can download the free GST reconciliation template and improve your efficiency.

Download Free GST Reconciliation Worksheet »5 Top Importance of Using GST Reconciliation in MS Excel

GST reconciliation in Microsoft Excel is important for all sizes of companies and businesses to ensure GST return fields are accurate and match the regulations. Also, it’s essential to save time, identify and minimize errors, and ensure smooth audits.

The importance of the GST reconciliation will urge you to implement it as soon as possible to avoid any errors or penalties by the law.

Here are the top five importance of using GST reconciliation in Microsoft Excel:

1. Accuracy Check

GST reconciliation ensures the purchase book data matches the information provided in the GST returns. It’s important to maintain good customer service and abide by the law.

2. Compliance Assurance

GST regulations are strict, and the Excel GST reconciliation ensures you are following the right path. It keeps your business safe and away from all the frauds and complaints.

3. Time and Effort Savings

GST reconciliation in Microsoft Excel is an amazing way to find errors quickly. Therefore, it uplifts your effort and saves precious time.

4. Error Identification

The GST reconciliation shows the specific place of error. So you can quickly change the data and fix the information.

5. Smooth Audits

A good and well-organized GST reconciliation is necessary to pass the audit by the authorities. You can show proof and the regulations you follow by using the GST reconciliation worksheet.

All the above reasons are sufficient to understand the necessity of GST reconciliation in Microsoft Excel and use them for betterment.

Advantages of GST Reconciliation in Excel

GST reconciliation in Microsoft Excel provides a lot of flexibility and advantages to a company and business. You can boost your accuracy, save time, track the records easily, find errors quickly, and increase transparency with customers and authorities.

The following passage will describe the advantages of using GST reconciliation in Microsoft Excel in detail.

Read the article below to learn the advantages of using GST reconciliation in Excel:

1. Boosts Accuracy

Microsoft Excel eases the GST reconciliation process and improves the accuracy level. You can input and ensure the correctness with more confidence.

2. Time Saver

GST reconciliation in an Excel worksheet saves you time. You can use the function and quickly drag information to save time.

3. Easy Tracking

There are multiple sheets in an Excel GST reconciliation. But, it’s very easy to find from where the information has come and track them to find all the information and changes made to it.

4. Error Detection

Excel nails it when it comes to error detection in data. You can compare and match the data with simple equations and easily find the errors.

5. Enhancing Efficiency

Excel saves time and effort for a person and makes it super efficient for a company or business. You can check and complete a large amount of GST information within a short period.

6. Increasing Transparency

Maintaining transparency with the consumer is the key to success for any company or business. The GST reconciliation allows you to maintain and provide the necessary information to the authority without any issues.

Ending Note

Every company or business needs to pay GST (Goods and Service Tax), and it becomes crucial when it is one of the most important sectors for government revenue.

Therefore, you must use VLOOKUP, SUM function, or Pivot Table in Microsoft Excel and carefully calculate the GST reconciliation.

I hope you have found every method helpful and easy to apply. Cheers!