Everyone in this world expects to get a return after a loan or investment. The Present Value or PV determines the amount you will receive according to some arguments.

It is a concept that helps us to compare the value of money today and in the future. It’s essential for every financial sector to analyze better outcomes.

In this article, I’ll explain the Present Value and provide an efficient way to estimate worth using a PV calculator.

So, let’s begin.

What is the Present Value in Microsoft Excel?

The Present Value (PV) in Microsoft Excel is a financial function that calculates the current value of a future cash flow or investment stream. The PV formula is widely used to determine the value of future payments, such as annuities, loans, and investments.

Let’s understand the function with an example.

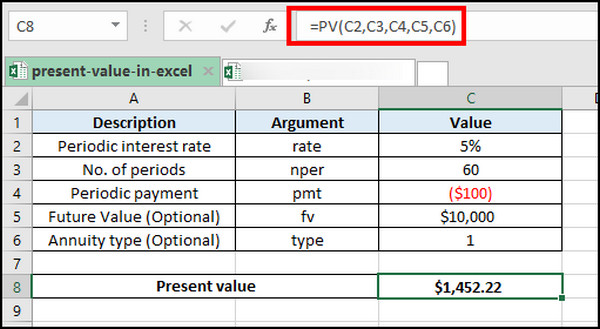

Suppose the periodic interest rate is 5%. You will pay 60 monthly payments of $100 and expect a future value of $10,000.

To fulfill this criteria, how much should you invest now? The answer is $$1,452.22, and that’s what we will bring out by using the Present value.

Important Things to Know Before Using Present Value (PV) Function

Before using the Present Value or PV function in Microsoft Excel, you must know the basics and explanation of the function.

The basic Present Value (PV) function is:

= PV(rate, nper, pmt, [fv], [type])

Here is the explanation of the arguments in the PV function:

| Arguments | Explanation |

|---|---|

| rate | The interest rate per period. |

| nper | The number of periods. |

| pmt | The payment is made each period. The amount is constant and remains the same throughout the period. |

| fv (Optional) | Future Value is the final amount you expect after completing the last payment. It is assumed to be 0 if omitted. |

| type (Optional) | It specifies if the payment is due or not. 0 or omitted means the payments are assumed to be made at the end of the period. 1 means the payments are assumed to be made at the beginning of the period. |

Now, let’s jump into the calculation and determine the Present Value (PV) from the following passage.

How to Calculate Present Value in Microsoft Excel

To calculate the Present Value (PV) using Microsoft Excel, you need to identify the interest rate, number of periods, payment per period, future value, and payment type. For the annuity calculation, you have to provide annuity terms per year and total periods per year.

Here are the steps to calculate basic Present Value in MS Excel:

- Open an Excel sheet.

- Provide rate, nper, pmt, fv, and type arguments value.

- Type the function =PV(rate, nper, pmt, [fv], [type]).

Here, we have used C2, C3, C4, C5, and C6 cells to calculate the Present Value.

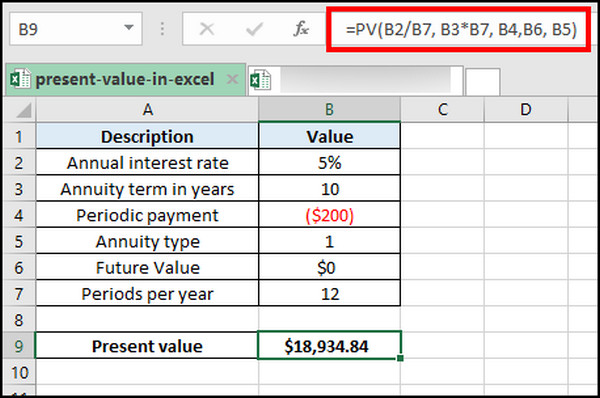

To calculate the annuity PV formula, you will require annuity terms in years and periods per year information.

Follow the process below to calculate the annuity Present Value:

- Type rate, annuity term in years, pmt, type, and periods per year value.

- Use =PV(rate/periods per year, annuity terms in years*periods per year, pmt, fv, type) formula.

Download Free Excel Present Value (PV) Calculator

I’ve included all the Present Value formulas described here in my Excel worksheet template. You can download the free Excel Present Value calculator and test or determine the PV.

Download Free Excel Present Value (PV) Calculator »Why Should You Use Present Value in Excel?

You should use the Present Value or PV formula in Microsoft Excel to determine the affordability of a loan and evaluate the opportunity for an investment. In addition, you can calculate an asset’s fair or original value and analyze it better by tweaking different arguments.

Consider reading the following points to learn more about the applications of Present Value in Microsoft Excel.

Here are the uses of Present Value in MS Excel:

Determining Affordability

The PV formula allows you to calculate and check the present value of your loan payments. It will help you determine if you will be able to pay the amount properly.

Evaluating Investment Opportunity

Calculating the Present Value can give you an advantage to make a suitable investment. You can try different approaches and investment options to find the most profitable opportunity.

Calculating Fair Value

The Present Value of an asset’s future cash flows can determine its fair market value. Therefore, you can check the value and find its worth in the current market.

Analyzing Asset Value

The Present Value depends on multiple values, such as rates, time, payment amount, etc. You can tweak the values and analyze the outcome for better investment and profit.

All the above uses will help you understand the importance of Present Value and utilize it for more remarkable results.

Difference Between PV and NPV

Present Value (PV) and Net Present Value (NPV) are both financial concepts that determine the value of money over time.

Many people think PV and NPV are the same, as they sound very similar. However, massive differences exist between them—from definition to usage.

Here are the differences between Present Value (PV) and Net Present Value (NPV):

| Feature | Present Value (PV) | Net Present Value (NPV) |

|---|---|---|

| Definition | Current value of future cash flow. | Difference between present value of cash inflows and outflows over a period. |

| Purpose | Determining the current worth of a single sum. | Calculating the profitability of an investment. |

| Investment Evaluation | Positive Present value determines higher returns or affordability. | Positive NPV indicates higher profitability. |

| Applications | Affordability of investment, loans, fair value of assets | Investment evaluation, decision-making, capital allocation. |

The PV vs. NPV tables will help you differentiate and make the right call at the right moment.

Conclusion

Present Value calculator is a quick way to determine the current worth of an asset. You can identify and find the best way to profit using this method.

You can apply the basic Present Value function or try the annuity PV function to calculate your possible outcome and aim for a future value.

Cheers!